Breaking stereotypes, say that in Thailand you can not only sunbathe, swim and relax in Thai massage salons. Here too shopping! Thailand, like many other countries, encourages foreign tourists shopping. For this purpose, a mechanism has been developed. VAT refund in Thailand, which is called “Vat Refund for tourists”. Tax on value added in this country is 7 percent. Agree this is not enough. For example, from the spent 10,000 baht you will be returned 600 baht 100 baht will have to pay for a commission. Your shopping in Тайландес нашими советами станет выгодным!

Если вы в аэропорту Бангкока и не знаете дорогу, спросите наrack information.

Contents

Small introduction

The mechanism of VAT refund is quite simple, but it is not useful. all, and those foreigners who commit repeated and not the most cheap shopping in stores in Thailand. Registration Service Vat Refund in Thailand offer all the major outlets. Any Thai supermarket or large store has departments over which flaunts the “Vat Refund” sign. If the department there is no this information plate, the staff will always tell you where This store has a VAT refund desk. Always have a passport with you – the lack of it will cause failure registration Vat Refund.

Treat your passport in a foreign country Take care not to lose it! But if it is still happened, the article “Actions in case of loss of a passport in Thailand “to help you.

Vat Refund at Suvarnabhumi Airport

What you need to know about the VAT refund in Thailand

- They will refund VAT (Vat Refund) when you return home in Thai airports, for example, at an international airport Bangkok Want to return the money – fly the plane.

- Blancina 7% tax refund must be issued at the store immediately after purchase. Do not forget about it.

- The amount of the purchase should not be less than 2,000 baht, and in total Difficulties for the trip need to spend at least 5000 baht. In some stores clearance is made on the amount of all checks.

- Keep all your checks and documents – this is important! Why lose money?

- If you are relaxing with the whole family in Thailand, arrange everything purchases per person, for this show in points Vat Refund registration of his passport (photocopy). So it will be easier for you collect the required minimum amount for a refund.

- According to the rules, VAT is returned only for jewelry. (buying silver in Bangkok). If you want to return the VAT, do not buy precious stones without processing (buying pearls in Phuket). It is better please yourself or your beloved with beautiful Thai ornaments.

- VAT refund in Thailand is possible, if from the time of purchase it has not yet 60 days have passed. Keep track of dates on checks!

- The service is available only to tourists. If you’re a crew member, who flies to Thailand, then it does not apply to you.

Location of Vat Refuld racks at Bangkok Airport

How is everything going?

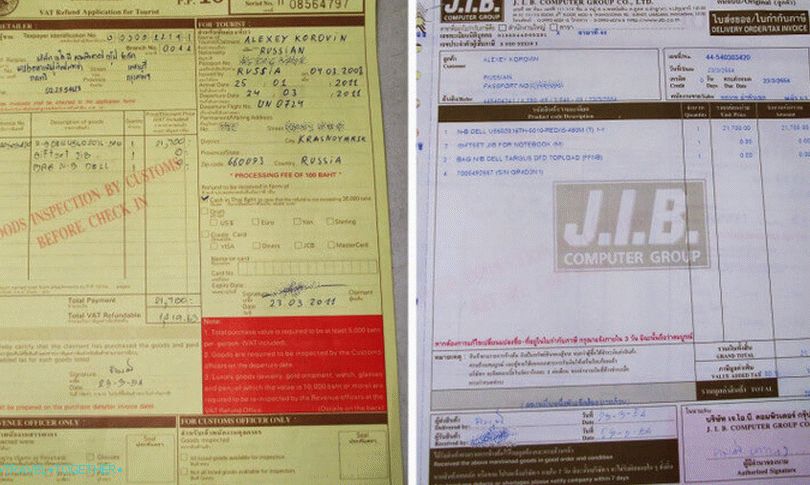

In the shopping center according to your passport are filled Forms: VAT Refund Application for Tourist and Delivery order / Tax invoice. A check for purchases is attached to them. These papers and Your passport must be shown to a Thai customs officer before registration for the flight. By the way, the product itself and the integrity of its packaging. can check. After the customs officer stamps all checks, you can check in for the flight and passport control.

Forms VAT Refund Application for Tourist and Tax invoice

In the departure area you need to find a rack with a Vat Refund sign. There and VAT will be refunded. Payment is made in Thai baht, you can immediately spend on purchases in stores Duty Free. If the refund amount is not more than 30 000 baht, then the money can you return in cash, by credit card or by check. Exceed amount – only card or check.

If the article about VATVam seemed interesting, then perhaps You will be interested in and other similar materials on taxes on purchase or sale of housing in Thailand.