Insurance, which will be discussed in this article, the insurance companies is called a travel insurance policy insurance or traveler health insurance more convenient to call her.

In order to get out of the unpleasant case, whole, cured and do not spend much, you should understand this system. because that insurance – like any such office – really wants to sell you policy, but then really does not want to pay. Therefore, to have dealing with this system, it’s better to figure out how it works; really read the policy – and not just sign it. And better understand in advance what to do if something happens. To not make mistakes that will allow the insurance to refuse treatment or then pay for this treatment.

The content of the article

- 1 How to choose an insurance company

- 2 How is considered the beginning of the insurance

- 3 What to do if the insured event occurred on the last day insurance

- 4 How to extend the insurance

- 5 How to pass an insurance policy if the trip did not take place

- 6 How to buy insurance online

- 7 What kind of insurance to do if you are going to ride bike

- 8 Elderly Health Insurance

- 9 Does insurance cover chronic diseases?

- 10 On a long trip how best to insure, at home or on place in the host country?

- 11 Why get insurance in Schengen

- 12 Where better to buy insurance for a Schengen visa

- 13 The cheapest insurance for a Schengen visa

- 14 Why make insurance to Asia

- 15 Where to buy ISOS Assistance Insurance?

- 16 How to know in advance the hospital, where they will direct

- 17 Are insurance stamps looking at border crossings?

- 18 Can I buy multiple policies in a row?

Contents

- 1 How to choose an insurance company

- 2 How is considered the beginning of the insurance

- 3 What to do if the insured event occurred on the last day insurance

- 4 How to extend the insurance

- 5 How to pass an insurance policy if the trip did not take place

- 6 How to buy insurance online

- 7 What kind of insurance to do if you are going to ride a bike

- 8 Elderly health insurance

- 9 Does the insurance cover chronic diseases?

- 10 With a long trip how best to insure, at home or on place in the host country?

- 11 Why get insurance in Schengen

- 12 Where better to buy insurance for a Schengen visa

- 13 The cheapest insurance for a Schengen visa

- 14 Why make insurance to Asia

- 15 Where to buy ISOS Assistance Insurance?

- 16 How to find out in advance the hospital, where they will direct

- 17 Do insurance marks on border crossing look

- 18 Can I buy multiple policies in a row?

How to choose an insurance company

First of all, I want to advise mega useful comparison service insurance prices – Cherehapa. Long awaited! For several years now As the purchase of insurance has become much easier. No need now check a bunch of websites of insurance companies, go to Cherehapa and Immediately see the prices for 16 insurance and buy in the same place.

Most of the most negative reviews on the Internet insurance representatives answer reasoned why insurance didn’t work. But behind each such case are living situations – when a person was frightened for health – his or a loved one, I was confused and made some legal mistake – and in the end did not I got the help I expected when I paid for the policy. To prevent this from happening, one should not just be insured, but also carefully read the documents that you give. And in advance understand the sequence of actions, what you can count on, and what not.

The insurance company that sells your policy works with one from the assistance (service) companies. About several major Assistants I wrote in my article Travel Insurance, and also gave a list of insurance companies with their assistants. Also there and other nuances are described, including good insurance-asistens bundles, be sure to read!

My insurance rating →

When an insured event occurs, the victim does not call in his insurance – and in this assistant company. Just how polite and communication with the operator will be qualified, depends on Assistance company, and not from the insurance. What hospital send, take care of transport or have to call a taxi, will you have to pay the bill in the clinic yourself (and the money from the insurance receive after returning home), will they take a pledge passport and how many calls will it take to get this passport – depends on the work of the assistance company.

But we must understand that the decision to pay bills does not take Assistance company, and insurance. Thats how fast you agree to see a doctor, call a car – or have to go to Taxi, whether they will give the go-ahead to pay for treatment or not – this is already a decision insurance company. Unfortunately, insurance without negative there are no reviews, it will have to be taken as a fact, and to choose from fewer evils less.

How is considered the beginning of the insurance

You must carefully read the terms of a particular insurance company – because different insurance policies have different rules. And read exactly policy that you sign because often the policy agreement different from that published on the site.

Usually when you apply for an insured event, you have ask the date of entry into the country and may be asked to scan and send all passport pages to make sure you haven’t spent all the days abroad on this policy.

If you have two policies, one of which has 10 days left, and another 5, they are not plus, but spent at the same time – because every company will check your days for by the border.

What to do if the insured event occurred on the last day insurance

If the insured event occurred on the last day – the main thing have time to register it (call the assistant) before the end policy actions. All insurance conditions are different, but usually insurance provided that the treatment takes some time and may continue after the end of the policy. But how much days is given for treatment after the end of the policy – depends on conditions specific insurance.

What exactly does not make sense is to buy some more days of the same insurance, because they insured will not be distributed. This is a new policy, it can not have relationship to something that happened before its purchase.

Moreover, if the insurance agree to issue a policy remotely – such a policy starts in a few days

How to extend the insurance

Extend the insurance policy can not be. You can buy a new one. But we have to take into account that not all insurance companies sell policies through The Internet, and not all insurance companies, it will be considered valid without crossing the border. That is, it is assumed that you buy a policy, being in Russia, and then you cross the border.

Also, some insurance has a temporary delay. For example, when buying a policy from Liberty, while abroad, wait 5 days after purchasing the policy before it starts act (that is, you can specify the date of the beginning of the policy today’s number, and counted 5 days ahead). So they are protected from scammers trying to buy a policy on the day of occurrence medical problems.

Details of the insurance that you can buy while already abroad, I wrote in this post.

How to pass an insurance policy if the trip did not take place

Different insurance policies may vary, but usually before actions of the policy can pass it and get back the cost of the policy minus the cost of overhead. This is usually about a third of the cost of the policy.

After the start of the policy, it is usually impossible to turn it in, even if You used 2 days from half a year.

How to buy insurance online

When making an insurance policy via the Internet instead of printing use an electronic signature that is no worse than a stamp on paper policy. (“Federal Law” On Electronic Signature “№ 63-FZ of 11/06/2011 g. “) It is possible and to err, after purchase policy call the company and check it by number. I have already several times bought policies Absolute, Concord, Liberty, through service Cherehapa, and did it every time online, paying by credit card. No problem, the policy came to my email in electronic form, and then I used it in the right country.

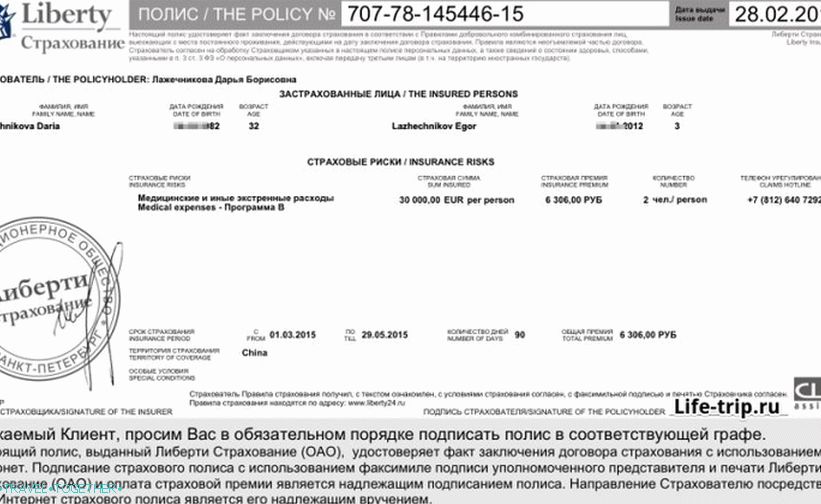

This is what traveler insurance looks like (plus several more pages of the contract)

The main thing, if you are not already in Russia, be sure to ask before you buy, when it will act, and not Is it even prohibited by the rules of an insurance company to buy a policy? being abroad. Because, for example, according to the rules of the same Liberty, the policy in this case will take effect after 5 days. BUT Many companies do not sell a policy at all to a person who is already is not in Russia. Details about the insurance that you can buy being abroad in this post.

Many companies in case of an insurance case are asked to send a copy of all pages of passport. If it turns out that at the time of insurance the person was not in Russia, this may serve as a pretext for insurance recognize the policy as invalid (and, accordingly, refuse pay for treatment).

What kind of insurance to do if you are going to ride a bike

It is necessary to carefully read the conditions of your insurance, that written in the insurance contract. According to the rules of most insurance companies riding a bike (motorcycle) is covered only by package “Sport” or “Active Leisure” (and not covered by the usual). Need to read the rules of each insurance. Or go to the same Cherehapu and put a tick in front of “Movement on a motorcycle / moped”, which is located in the section “Sports and active recreation”. Then you will immediately see the price change and the filtered results. on insurance.

Some insurance management bike is standard package. One example of Tripinsurance.

When an insured event occurs, always be prepared for issues:

- who was driving

- if the victim was driving, does he have a category right BUT

- did the victim drink alcohol (and at the hospital may make a test for alcohol, not believing the word).

The last question to solve the insurance key is if you drank, then no case will be recognized as insurance.

Category A rights also play a significant role – quite normal and normal situations when, despite buying a sports insurance, the insurance ultimately refuses to recognize the case insurance, referring to the lack of driver of the right category. Therefore, those who drive without a license often pretend to be passengers or they don’t say that they fell from a bike. Respectively, if you do not have rights, then there is no point in making insurance with additional package, only in vain to overpay. Yet i would recommended driving with rights or trying not to mention bike

Elderly health insurance

Not all insurance companies make travel insurance. over 65, and almost all introduce payables (i.e. cost increases several times). Rosno insures up to 85 years the coefficient starts to accrue from the age of 65, but about Rosno There are not very good reviews and some of them are from retirees. Bean insurance, the former first insurance company has insured before 80 years, now changed the rules and insures only up to 70. Liberty insures up to 100 years.

It must be borne in mind that the treatment of chronic diseases will not none – only symptoms, that is, in fact – analgin. So in In any case, you must take with you a huge first-aid kit from all your chronic diseases.

Does the insurance cover chronic diseases?

Traveler travel insurance does not cover treatment chronic diseases. What is meant?

If there is a clear threat to life, then the insurance pays for urgent measures. But does not pay for treatment. For example, in case of aggravation gastritis is likely that the doctor will give painkillers and will not give nothing from gastritis. Or that the doctor will give the necessary pills – and insurance will refuse to pay admission. Insurance usually does not refuse to pay at a low cost, but it must be borne in mind that such a case may be recognized as not insurance. It is better not to rely on insurance in in this case, and take medicines for your chronic diseases.

What happens in a situation where a first-aid kit is indispensable and real medical intervention is necessary – for example, in the case of heart attack, ulcer perforation and so on. According to the rules most insurance companies, they pay for hospitalization if there was a clear threat to life. That is, doctors must lead you to transportable condition and after that the insurance will pay sending the patient home (if the insurance has such a point). But it should be understood that in such cases the insurance company may try to find a reason not to pay the bill. There are also restrictions on the maximum amount that is less than the sum insured – for example, $ 10,000 instead of $ 50,000, which is valid for the rest cases.

You can try to protect yourself and ask the doctor to write: – there was a threat to life – the intervention was urgent – that this the case was not an exacerbation of a chronic disease and was not caused by

But you know, not every doctor will be willing to risk his license and get involved in such matters.

With a long trip how best to insure, at home or on place in the host country?

Minuses:

1. The local medical insurance policy starts to work not in day of purchase, and after some time. Plus, until the hands reach do insurance, until you find an agent, while you make insurance – It will take a lot of time. If something happens in the first days, insurance for these days will not, this is the first minus. Also, in airplanes and on the road, of course, only insurance works traveler, local insurance will not help.

2. The company that will insure you will have to search. And not in all countries it will be easy to find it. And not all countries are agents will speak English. From known and present in many countries have advised Bupa.com, but it is expensive.

3. Insurance in a local company, as a rule, will expensive.

4. There are services that are not covered by local insurance. definition. For example, the repatriation of the body to their homeland.

5. The local company will almost certainly not have support on Russian language.

Pros:

1. With some reservations it is possible to treat chronic diseases. Reservations are mainly related to the timing – for each chronic Diseases have their time from the beginning of the purchase of insurance.

2. You will not be offered to send you to be treated at home. the slightest hint of an operation, but will be guaranteed to be treated for place

When traveling less than six months, local insurance looks somehow meaningless: chronic diseases get covered so quickly do not start, travel insurance will be decently cheaper. With a trip more than a year is quite meaningful, at least by the fact that insurance will not try to send you home treatment. Although, in in some cases, it is rather a minus.

Why get insurance in Schengen

First, it is a must-have. That is, it will be checked as at least once – when they will apply for a visa. The second time it can check at the entrance to the border. In fact, it is very tested and very rarely, but if they check and discover its absence – or forced to buy it right on the border, or sent home. I have there is a whole post about all sorts of nuances – Insurance for Schengen visas

Secondly, medicine in Europe is quite expensive, and insurance it’s cheap enough there, so it’s easier to buy insurance than not buy.

Where better to buy insurance for a Schengen visa

You can not even think about it and do about the consulate until will be in line for a visa. Or right in the agency, which you will issue a visa. But I personally prefer to buy insurance. via the Internet because it takes literally 5 minutes of time. Moreover, I know what kind of insurance I will take, and what all I wish – to read reviews about insurance, about asistens with which these insurance work and make a choice with open eyes. God forbid have to use insurance, but it may not be working and will refuse because of the far-fetched reason.

Currently I prefer to buy for myself and my family. insurance through Cherehapa. Already 10 times had to use insurance, and while problems and questions have not arisen. But the main thing, it seems to me, is not to make insurance the cheapest insurance or the first available. If you do not know what kind of insurance choose, you do not understand what is assentans, and in general you have a lot Questions, then look at my generalizing post about insurance traveler.

The cheapest insurance for a Schengen visa

Ahead of the whole planet Eurotour agency. Yes, exactly agencies are the cheapest insurance, there is simply no cheaper. Eurotour sells them online, get your hands on a policy from Alfa Insurance with Savist’s astistas, which is pretty good.

Another option is to pay less for insurance, for example, for annual Schengen – is to issue it only on the first trip. Some countries allow this, you need to carefully read the rules visa in a particular country. It also makes sense to save watch annual insurance.

Separately, also see my TOP 10 cheapest insurance for Schenegen.

Why make insurance to Asia

Insurance in Asia is not necessary, unlike Schengen. therefore “do or not do” is left to the will of the traveler.

In principle, medicine in Asia is not as expensive as in Europe. AT Thailand, for example, usually has two different hospitals: one, expensive, works with insurance, and second, cheap, works for cash. True, there are different opinions on this score, someone advises to go cheap, someone says that only expensive and nothing else. But in general, treatment in a foreign country will cost you more than in his, if only because in Russia shareware medicine, plus you will not know exactly where to go and what to say. Thats There is insurance – this is some guarantee, especially for complex when serious treatment is required.

One of the most frequent cases in Thailand is a fall from a bike. It it is not covered by any insurance, but only by the one where it went into package, immediately or for an additional fee (choose the options when policy purchase). There should be no alcohol in the blood, and Need rights category A. Skating on the board, too, may not enter, so immediately find out the list of activities that will be insured.

Sometimes you can get medical treatment for cash. Think of a runny nose or leg abrasion. But, unfortunately, this situation may arise when cash is simply not enough. That is why there is this post, you need to understand why you are doing insurance, and when she worth using, and when not. Roughly speaking, loving drink and сесть при этом за руль прямая дорога в тюрьму госпитальbe treated for cash.

Where to buy ISOS Assistance Insurance?

Previously, the insurance agreement worked with the ISOS Assistant and a couple of others, but then they stopped selling ISOS insurance, Now they have another asistens. ISOS generally stopped working on the territory of Russia since the end of 2014. Some time insurance against he could be found at some premium bank cards (for example, in Raiffeisen), but now in 2015 I have not found them there. It is a pity, good was asistens, the best. True, not very cheap. The only option where you can buy it now is directly to its official website. Only support will be in English and prices are unlikely to please you.

How to find out in advance the hospital, where they will direct

In short, no way. For some reason this is “secret” information. The fact is that it’s not insurance that directs you to the hospital. service company (assistance). And depending on which hospitals this agreement has a contract, there will be guide. Sometimes one more time is used (usually you you don’t even know) and also to have a contract with hospitals. But all this is an internal kitchen and you do not have access there. You can call insurance or assistance, but they will answer you when you have an insured event, then we will let’s say the address of the hospital, they say, depends on very many factors.

In fact, insurance for a certain period of time (say, a year), they send everyone to the same place. And you can try to find a description of insurance claims on the Internet (reviews) and there, as a rule, the city and hospital will be indicated. But it is dreary occupation, besides not a guarantee at all.

Do insurance marks on border crossing look

It depends. Sometimes they ask to send a photo with a stamp / visa in passport, sometimes not. Depends on the insurance and your case. Also depends on whether you have annual insurance and how many days be every trip (and how many trips per year). You understand that if any suspicions arise, they will definitely be asked. I would not violated all these terms.

Can I buy multiple policies in a row?

One of the questions is whether it is possible before the trip to buy policies for each friend, breaking up travel insurance into several parts. Can! But not all insurance companies. For example, ERV is mandatory claim – 1 insurance must cover the entire travel period, although the rules of insurance is not specified anywhere.

Life hacking 1 – how to buy a good insurance

Choosing insurance is now unrealistically difficult, therefore, to help everyone travelers, I make a rating. To do this, constantly monitor forums, I study insurance contracts and use insurance by myself.

Insurance Rating

Life hacking 2 – how to find a hotel 20% cheaper

First, choose a hotel on Booking. They have a good base offers, but the prices are NOT the best! The same hotel is often possible find 20% cheaper in other systems through the RoomGuru service.

Discount hotels